Global Wealth Management: Digitizing the Client Lifecycle for Efficiency and Client Experience

According to a recent report, the global private banking and wealth management industry is undergoing a buoyant resurgence after a difficult few years brought about by the global financial crisis of 2008, which saw a near 20% decline in global HNWI wealth.

With global HNW wealth expected to surpass $100 trillion by 2025, private banks and wealth management firms are now facing an unprecedented opportunity to grow both market and wallet share.

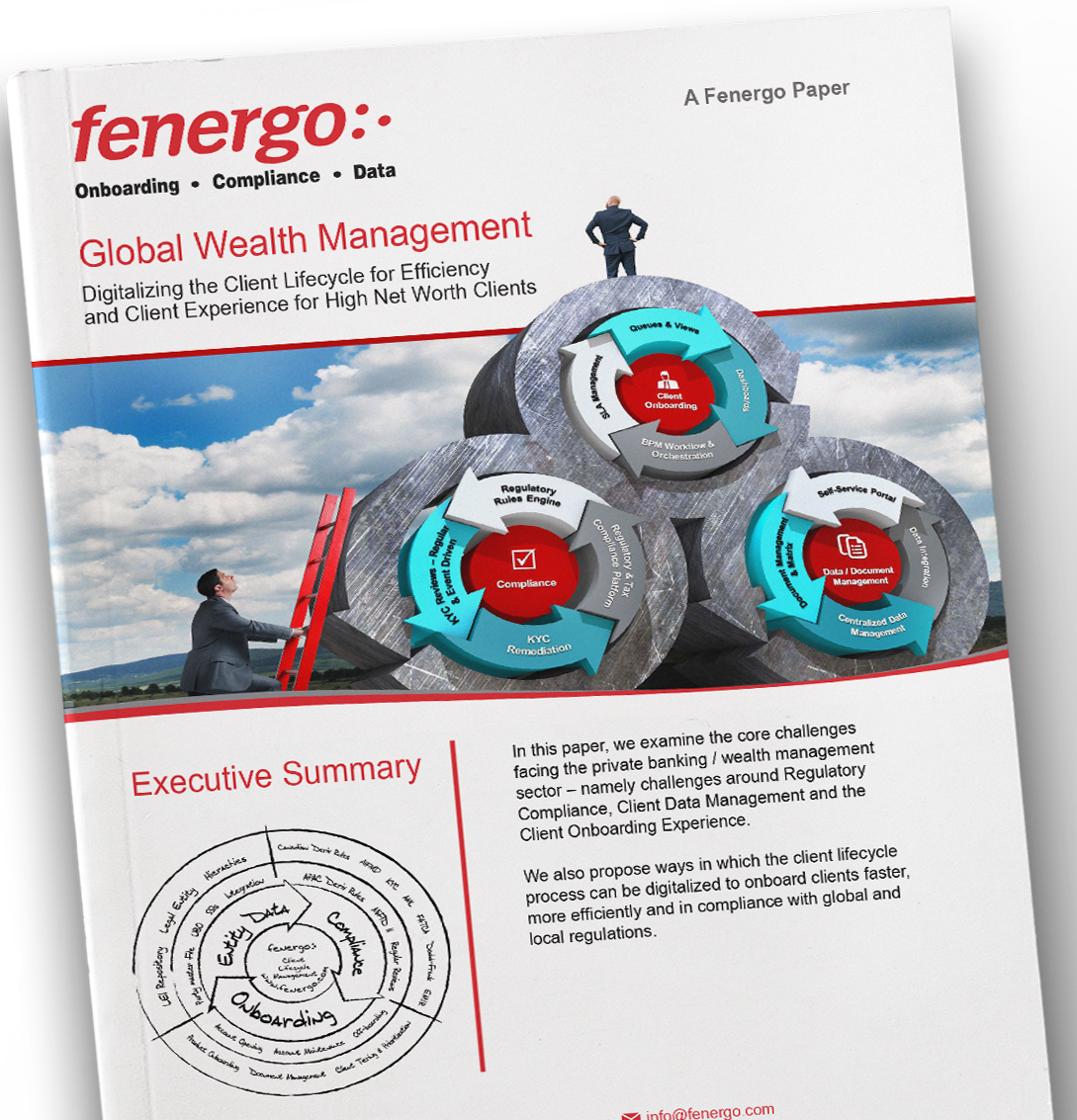

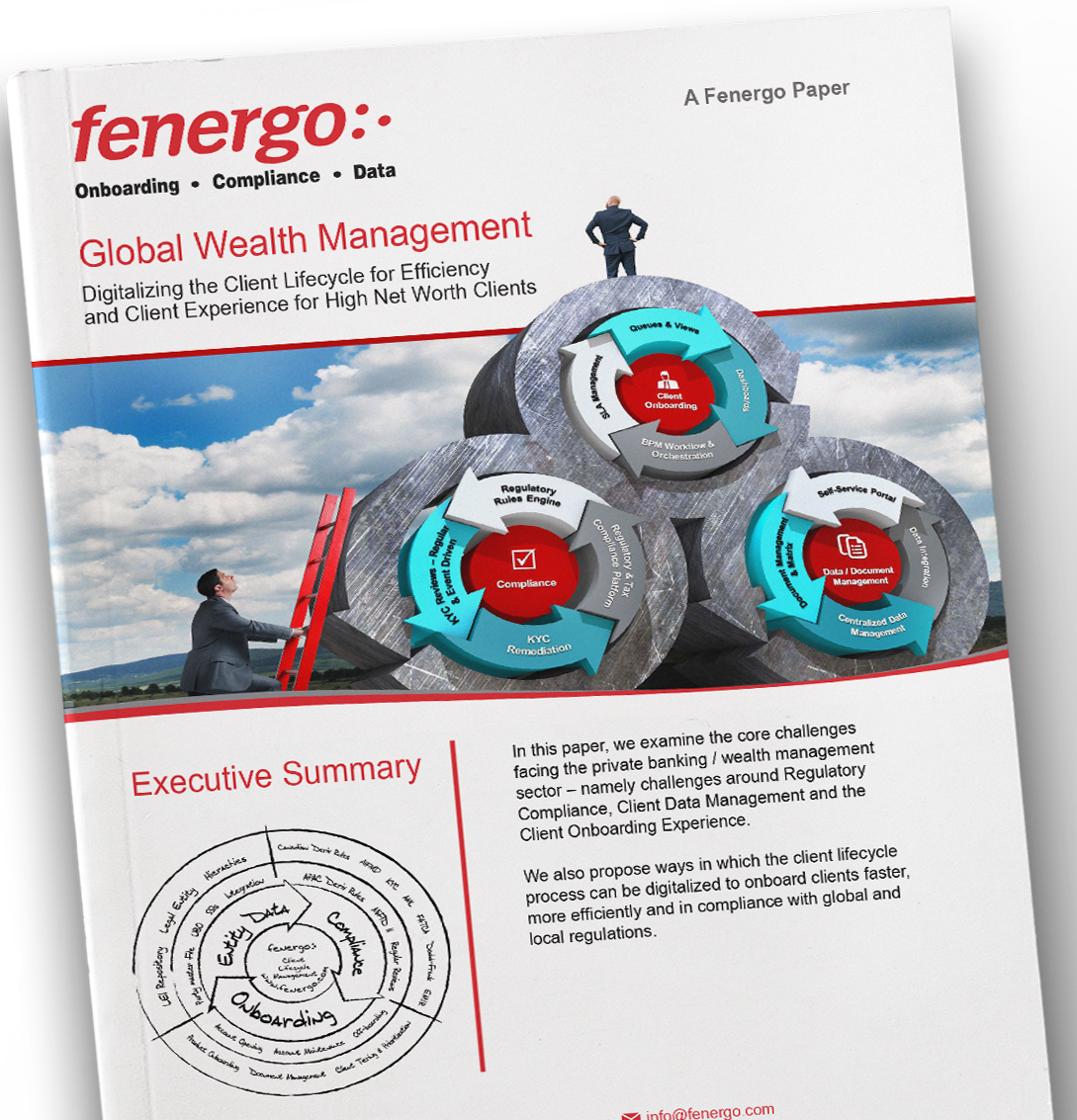

In this paper, we examine 3 core challenges facing private banks and wealth management firms:

We also propose a best practice approach to digitalizing the client lifecycle process ranging from Automating Regulatory Compliance, Rethinking Data & Document Management and how to Digitalize Onboarding BPM

Laura has significant knowledge and experience in the areas of risk and compliance. Having worked with hedge, mutual and private equity products across multi-jurisdictional platforms, Laura has developed a strong competency in AML and regulatory compliance.