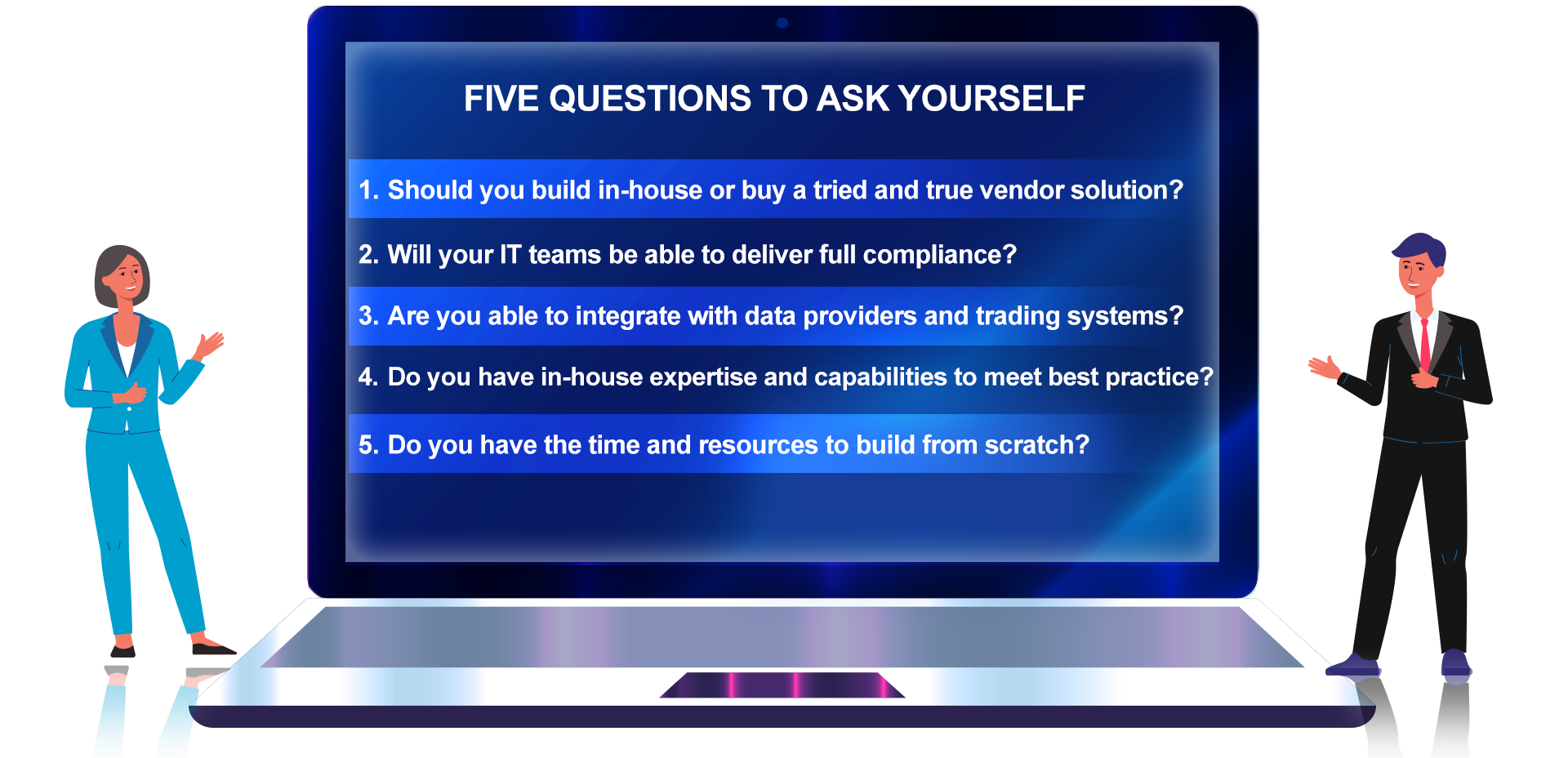

We work with leading financial institutions to devise, develop and deliver solutions that address these issues. We’ve encountered the buy vs build decision making process many times over the years.

For more information download our buy vs build brochure today!

In this video, Erik discusses how ABN AMRO works with Fenergo to address their KYC and digital transformation needs. Watch the full video and learn how this pioneering financial institution is delivering Digital KYC.

© 2024 Fenergo. All rights reserved. | Privacy Policy